Your gift will result in a tax credit that will reduce your income taxes in the year of your gift – or you can carry it forward for up to five years.

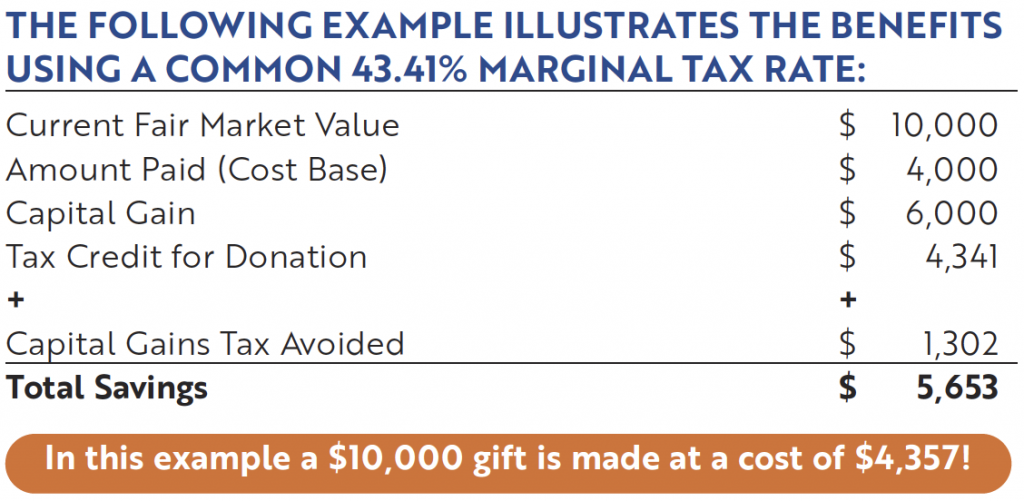

Securities like stocks, mutual funds and bonds that have appreciated in value and face a significant tax hit are a very cost effective way to donate.

Once you have determined an approach that ensures your donation maximizes your tax advantage, perhaps with the help of your professional advisor, all you need to do is:

- Fill in a simple 1 page form, available by:

calling us at 877-422-1112 ext. 801

or emailing us at giving@sciontario.org - Send the form to your professional advisor, bank or investment firm and they will send the securities to Spinal Cord Injury Ontario’s account.

- Let us know about your gift, or send us the form, so we can prepare your tax receipt.

If you have any questions We are here to help just email giving@sciontario.org or call Paul at 1-877-422-1112 ext. 801.

Your generosity will provide funding for essential support, service and advocacy for the more than 36,000 people living with a spinal cord injury in Ontario and the over 2,000 people who will experience a new injury this year.