Many people delay planning their legacy because they think it’s complicated to make a planned gift, like a gift in a Will. And although the subject of Wills can be uncomfortable for some, the actual process of adding to your

charitable legacy is quite easy.

Two forms of gifts make up almost all the planned gifts made in Canada: gifts in Wills and gifts of securities.

A Gift in Your Will

There is no denying that unfortunate events of the past months have made us all think about getting affairs in order so that our families and friends are cared for, and our legacy is honoured.

Those you love and the causes you care about are all part of your legacy. Of course, look after those you love first. Make certain they are taken care of. Then, you can determine a percentage of your estate, as large or small as fits your situation, to make certain the causes that are part of your life’s work will continue to be supported in the years to come.

It is important to mention that planned giving offers many ways to leverage your generosity, increase your impact, and lower your taxes. Making a charity the beneficiary of property, insurance, RRIF or RRSP are among many tax-smart options worth reviewing in the context of your goals and financial life but adding a few sentences to your Will is the likely starting place to add to your legacy of caring.

A Gift of Securities

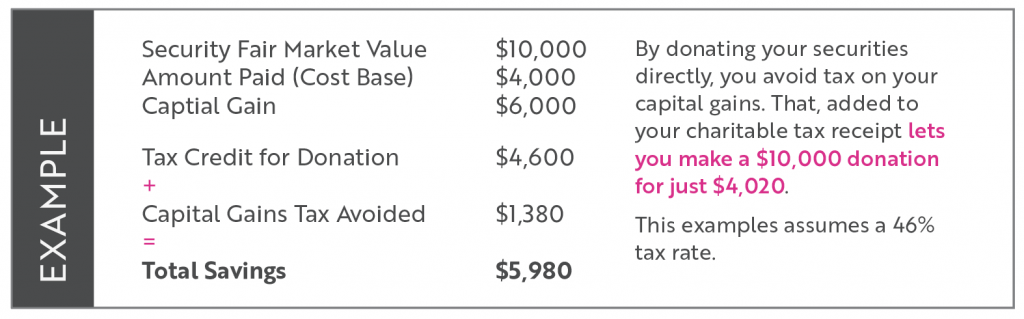

Donating securities is quick and easy. When you donate securities directly to a registered charity such as Spinal Cord Injury Ontario, you pay no capital gains tax on the appreciated value of your securities.

You also receive a tax receipt for the market value of your securities which produces a tax credit that will reduce your income taxes in the year of your gift (or you can carry it forward for up to five years).

Securities, like stocks, mutual funds and bonds that have appreciated in value and face significant taxation, provide another very tax-smart way to donate.

With the help of your financial advisor, determine an approach that maximizes your tax advantage. Your advisor can then assist with transferring the securities. It’s as easy as filling in a form and letting us know about it.

Your generosity will provide essential support, services and advocacy for the 36,000 people living with a spinal cord injury in Ontario and the 1,700+ people who experience a new injury each year.

Let’s Talk.

We would be happy to chat with you about making SCIO part of your legacy.

To get more information, receive sample language for your Will or the form to donate securities, please call Paul at 1-877-422-1112 ext. 801 or email giving@sciontario.org.

You can also find more information at visit sciontario.org/mylegacy